Help plan participants overcome inflation worries

Inflation is back, having surged over the past year to levels not seen in 40 years. After a decade-plus stretch of modest price increases, the consumer price index jumped 7% in 2021. This trend may continue for a while.1

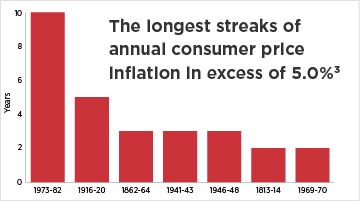

Sustained periods of high inflation are rare

While extended periods of inflation are infrequent, some economists believe inflation will settle at 3 - 4% and remain at that level for decades.2

While this new dynamic calls for adjustments to current household budgeting, it’s important that retirement investors also understand how inflation can impact their plans for retirement income and that they develop a strategy to protect it.

A sudden spike in inflation can lead to periods of market volatility and negative returns. This often triggers an urge to pull out of the market. But an emotional response could work against the investor’s long-term goals.

We invest to earn real returns

Individuals who stay invested in the stock market over the long term are employing a strategy designed to outpace inflation – that is, to earn real returns that can build wealth.

"Real returns" refer to the returns on your investments after accounting for inflation.4 For example, if the return for a bond mutual fund is 2% but inflation is 7%, the investor sustained a real return of -5%. This is why portfolios over-weighted in cash and bonds may underperform during periods of high inflation.

The good news is that, since 1926, the S&P 500 has had an average annual return of 10.49%,5 while U.S. inflation has averaged 3.25% annually.1 However, life rarely reflects averages, and past performance cannot predict future results. Thus, an investor cannot know when a down market might occur.

If retiring during or before a market downturn, the combination of withdrawals and poor investment performance could quickly deplete a retiree’s main source of income. This condition is called "sequence of returns" risk.

This risk may pose a significant threat because large market losses in the early years of retirement can shorten the longevity of a portfolio, even if better-than-average market returns occur in later years.

Add rising inflation to the mix and the investor might not be able to maintain their standard of living through retirement — or worse, they might outlive their assets.

In-plan guarantees help provide protection and growth potential

Designed for those seeking to mitigate the potential impact of inflation on their portfolio, these options were created to help protect retirement savings while providing portfolio growth potential.

Principal protection

Principal protection is provided no matter what the market does, and there’s also the opportunity for asset growth based on the performance of a market index.

Guaranteed lifetime income

- Participants can plan for retirement with the confidence that they’ll receive lifetime that isn’t dependent on market conditions

- Participants don’t have to choose between growth and protection, thanks to investment glide paths that offer growth potential to and through retirement

Should participants change their mind, in-plan guarantees are generally free of surrender charges and offer participants full liquidity without penalties. (Restrictions may apply.)

What is an in-plan guarantee?

An in-plan guarantee is an investment option that can be offered as part of a retirement plan’s investment lineup. These solutions offer various guaranteed features that are backed by an insurance company or companies.

[2] "Will Inflation Stay High for Decades? One Influential Economist Says Yes," The Wall Street Journal (March 9, 2022).

[3] Sustained periods of elevated inflation have been anomalous in U.S. history. According to data compiled by the Minneapolis Fed, in fact, consumer prices have risen by at least 5.0% across two or more consecutive years only seven times since 1800, with most of these episodes coinciding with war or its immediate aftermath. Transitory inflation has been much more the norm than the exception. Source: Federal Reserve Bank of Minneapolis, data as of December 31, 2021.

[4] "Real Return," Investor.gov/introduction-investing/investing-basics/glossary/real-return (accessed Feb. 22, 2023).

[5] "Compound Annual Growth Rate (Annualized Return)," Moneychimp.com (accessed March 14, 2022). The Standard & Poor’s 500 Index acts as a benchmark of the performance of the U.S. stock market overall. Individuals cannot invest directly in an index.